Project Overview: GIWA - Korea's Layer 2 Blockchain Ambition

Dunamu, the operator of South Korea's dominant cryptocurrency exchange Upbit, has unveiled GIWA, a Layer 2 blockchain built on Optimistic Rollup technology using the OP Stack. This represents a strategic pivot from pure exchange operations to blockchain infrastructure development, mirroring Coinbase's successful Base chain strategy.

The project name "GIWA" (기와) draws inspiration from traditional Korean roof tiles, symbolizing how individual blockchain layers stack to create durable infrastructure. The platform consists of two core components: GIWA Chain, the Layer 2 blockchain, and GIWA Wallet, a multi-chain wallet supporting Ethereum, Base, Arbitrum, Avalanche, and Polygon.

Current Development Status

GIWA Chain is currently operational in testnet phase, having already processed over 4 million blocks with one-second block times. The testnet demonstrates impressive technical capabilities, processing transactions nearly instantly compared to Ethereum's slower confirmation times. Developer tools including a block explorer and Web3 wallet integration are available for testing Brave New Coin.

Testnet

Operational with 4M+ blocks processed.

Performance

1-second block times & instant txs.

Wallet

Multi-chain support (Base, Arb, etc).

The GIWA Wallet remains in demo phase, with Dunamu expanding blockchain support incrementally. While no official mainnet launch date has been announced, the infrastructure development appears well-positioned for commercial deployment in 2025.

Korean Market Strategy: Leveraging Upbit's Dominance

Dunamu's strategic advantage lies in Upbit's market dominance. The exchange commands 73% of South Korea's crypto trading volume, managing 12 million users and 80 trillion KRW ($60 billion) in custody assets. This massive user base and liquidity pool provides GIWA with an unprecedented launch platform in the Asian market.

The company plans deep integration between Upbit and GIWA, allowing Upbit's market data, trading volumes, and user balances to be accessible on-chain. This mirrors Coinbase's successful Base chain strategy, where exchange integration drove rapid adoption. During the UDC 2025 conference, Song Won-jun, Dunamu's Crypto Product Lead, emphasized that Upbit's 4 trillion KRW in staking assets represents "powerful driving force" for GIWA adoption News1.

Global Expansion Beyond Korea

Contrary to regional expectations, Dunamu has positioned GIWA as global infrastructure, targeting international blockchain developers through Southeast Asian subsidiaries. This global approach differentiates GIWA from previous Korean blockchain projects that focused primarily on domestic markets.

The multi-chain wallet strategy supports major Layer 2 networks including Base, Arbitrum, and Polygon, indicating Dunamu's intent to participate in the broader Ethereum ecosystem rather than creating an isolated Korean blockchain silo.

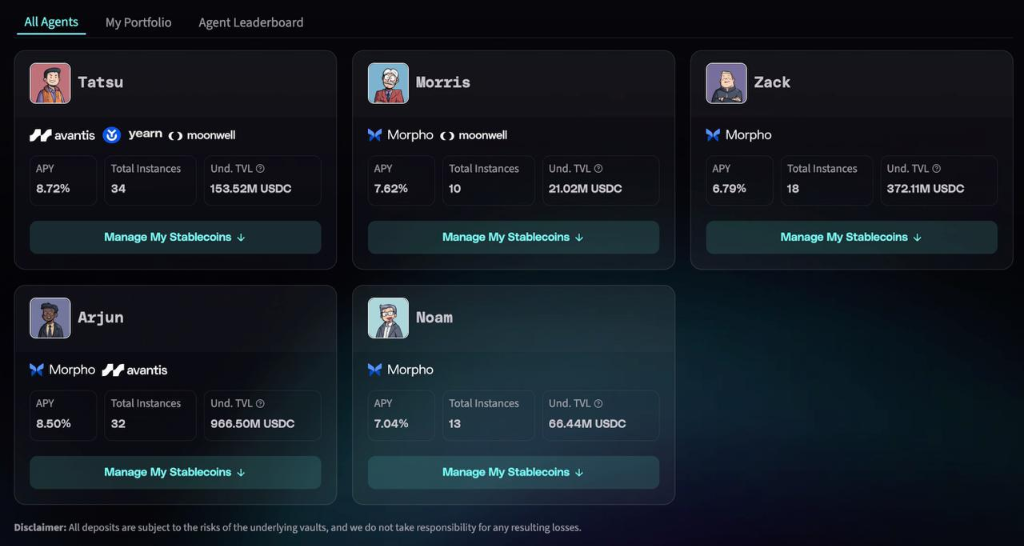

Stablecoin Market Ambitions

GIWA's positioning as a "financial-friendly blockchain" aligns with Korea's evolving stablecoin regulations. The platform's design supports stablecoin issuance and circulation, capitalizing on Dunamu's staking operation experience. This timing appears strategic, as Korea debates the Digital Asset Innovation Act which requires interoperability with international blockchain networks.

With Ethereum controlling 57% of the global stablecoin market, GIWA's Ethereum compatibility ensures Korean stablecoins can access international liquidity while maintaining regulatory compliance.

Strategic Implications for Korean Crypto Market

GIWA represents a significant evolution in Korea's blockchain ecosystem, moving from centralized exchange dominance to infrastructure development. This transition mirrors global trends where major exchanges develop their own blockchain networks to capture additional value from their user bases.

The project's success will depend on developer adoption, regulatory approval, and competition from established Layer 2 networks. However, Upbit's market position provides GIWA with unique advantages unavailable to most blockchain startups.

Conclusion: Setting New Standards in Asian Blockchain Development

Dunamu's GIWA launch signals Korea's maturation from crypto trading hub to blockchain infrastructure provider. By leveraging Upbit's market dominance while targeting global developers, GIWA could become a significant player in the Layer 2 ecosystem, following Coinbase's proven Base chain playbook.

The project's emphasis on financial services, stablecoin support, and regulatory compliance positions it well for Korea's evolving crypto regulatory landscape. As the blockchain industry consolidates around major exchange-backed networks, GIWA represents Korea's ambitious entry into this competitive space.