Executive Summary

The stablecoin infrastructure battle between Circle and Tether has reached a critical inflection point. While Tether's Plasma blockchain stormed out the gate in September 2025—reaching $5.6 billion TVL in just one week—Circle is preparing a two-pronged counterattack with Arc Network (L1) and Codex (L2) that could reshape the entire payments landscape.

Tether's First-Mover Advantage: Plasma's Blitz Launch

Tether's Plasma blockchain has already demonstrated the power of moving first in the stablecoin-native blockchain race. The network's explosive growth—$2.32 billion TVL within 24 hours and $5.6 billion within a week—underscores the market's appetite for purpose-built stablecoin infrastructure.

Institutional Win

Kraken integrated USDT0 deposits immediately, signaling strong exchange support.

Market Validation

Rapid TVL accumulation proves the viability of the USDT-as-gas model.

Strategic Timing

Launched ahead of regulations to capture maximum initial market share.

Circle's Strategic Response: The Two-Front War

Rather than a single counterpunch, Circle has orchestrated a sophisticated dual-pronged strategy that targets different market segments.

Arc Network: The Regulated Institutional Play

Arc Network represents Circle's bet on regulatory compliance and enterprise adoption. Currently in public testnet phase with mainnet planned for 2026, Arc offers:

Regulatory Ready

Built-in identity and compliance features specifically targeting major institutional clients and banks.

Privacy Controls

Selective transparency features allowing enterprise-grade applications to protect sensitive data.

Codex: The Enterprise-Focused L2

Codex, built on OP Stack, represents the more aggressive growth play, securing $15.8-16 million in seed funding from top-tier investors.

Enterprise First

Direct targeting of banks & fintechs.

OP Stack

Leveraging Ethereum security + L2 scale.

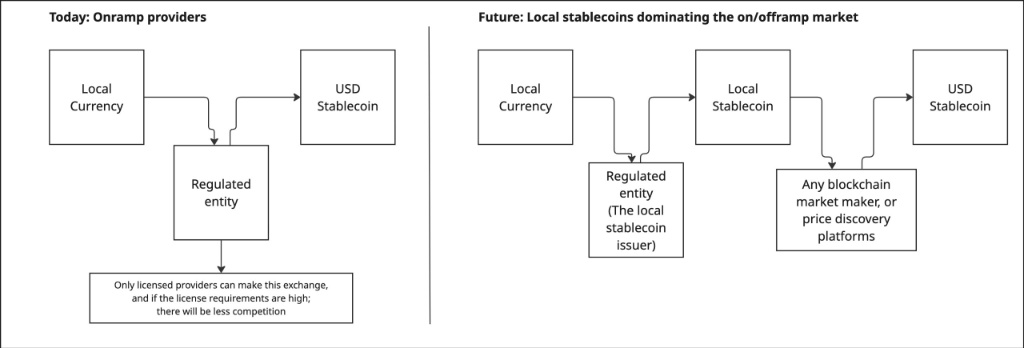

Reliable Ramps

Validator set of trusted off-ramps.

The Strategic Implications for 2025

Market Segmentation

Circle's dual approach targets distinct bases: Arc for large banks needing compliance, and Codex for fintech startups requiring flexibility.

The Token Wildcard

Both Plasma and Codex appear positioned for token launches. Arc maintains a no-token stance, though market pressures could force a shift.

Actionable Insights for Crypto Marketers

Monitor Codex's TGE

Arthur Hayes suggests significant upside potential; keep close watch.

Arc's Compliance Edge

Position Arc as the 'Safe Choice' for risk-averse enterprise clients.

Cross-Chain Integration

Highlight seamless USDC movement in your client pitches.

Conclusion

The stablecoin infrastructure war is far from over. While Tether's Plasma demonstrated market demand, Circle's strategic positioning with Arc and Codex could prove more sustainable. The next 6-12 months will be crucial as Arc's mainnet launch approaches and Codex's token generation event materializes.